Description

Manage your car safety and costs.

Car expenses tracker helps monitor and control car safety and costs for multiple cars. The application fits well for any individuals as well for the users who need to track the business use of cars (Uber, Taxi or couriers).

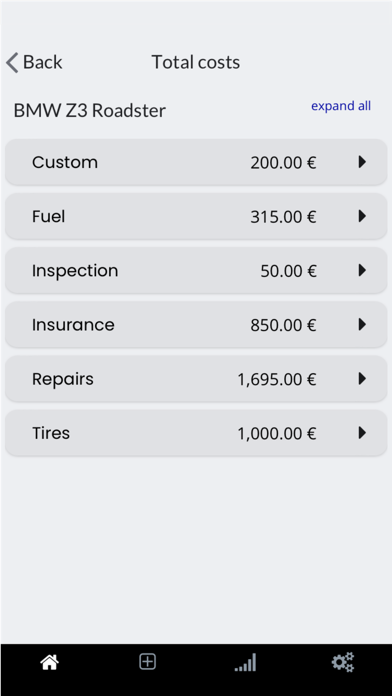

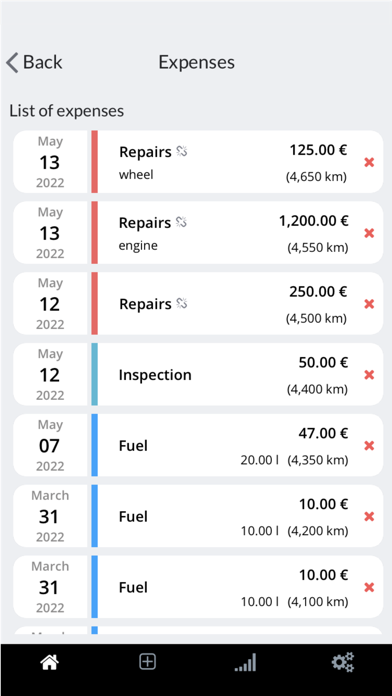

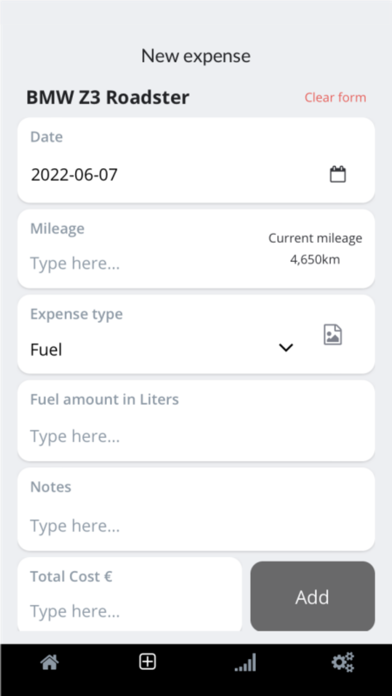

Car costs

The app helps you to monitor and control multiple costs e.g. fuel, charging, tolls maintenance, improvements and any custom cost. For every cost you can add the bill/receipt photo.

In the main view you can easily track total and monthly average costs of car expenses. You can also monitor current moth costs e.g. to keep car budget under control..You can also track the current car business expenses. In a single view you can compare which tax deduction method will bring a larger benefit.

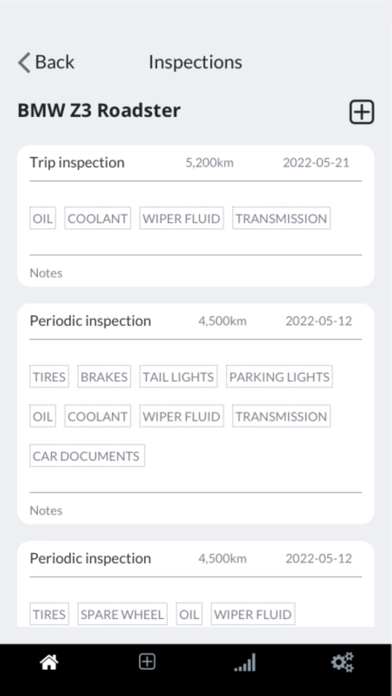

Car safety

Regular inspections are key for your safety and to keep the car in good health condition. In a few steps you can add and monitor car inspections including daily checks or regular inspections governed by country/state or daily check. The predefined inspection checklist includes most of the critical equipment like brakes, lights, horn, mirrors, seatbelts, tyres, and windshield wipers. In the regular check checklist you can mark items like fluid levels/change – engine oil, brakes, clutch, and auto transmission fluids (if relevant). Using the checklist you won’t forget to take documents, first aid kit or spare keys.

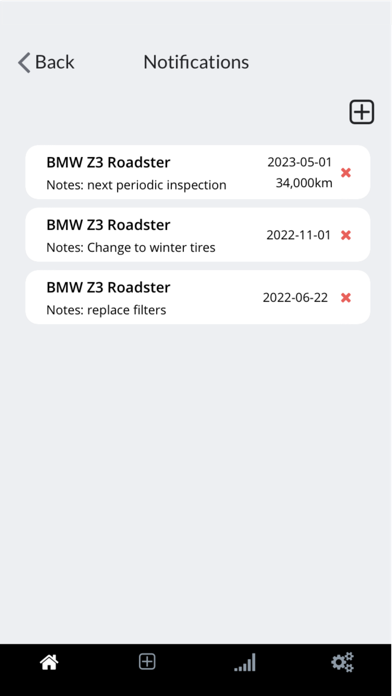

Car maintenance and remainders

With the car expenses tracker app you will never miss the important car checks, regular inspections, insurance payment or leasing payments. You can create “by date” or/and “by mileage” remainders, and once the criteria will be met you will be notified in app main screen.

Business use of car

The app will help employees, self-employed individuals, or other taxpayers with the recordkeeping of the car business use cost. Uber or taxi drivers, couriers in easyway can record their car business use spendings and control costs. The cost of ownership and operation can be then deducted from taxes if the country law allows that. The IRS (Internal Revenue Service), ATO (Australian Taxation office) and Polish “kilometrowka” car expenses tax deductible methods are embedded in the app with the actual fiscal year rates. You can also define your own customized rates based on your country tax law. You can record and monitor both “Standard Mileage Rate” and “Actual Expenses”. Then you may want to figure the deduction using both methods to see which provides a larger deduction. The recorded business use costs can be easily exported to the CSV file for further processing.

Guide how to calculate the cost of using your car in your business: masteryourmoneysmart.com/car-expenses-tracker-faq/

Export to CSV

The deductible car business use costs can be exported to the CSV file for further processing. Both Standard Mileage Rate and Actual Expenses methods are available for current and past fiscal years.

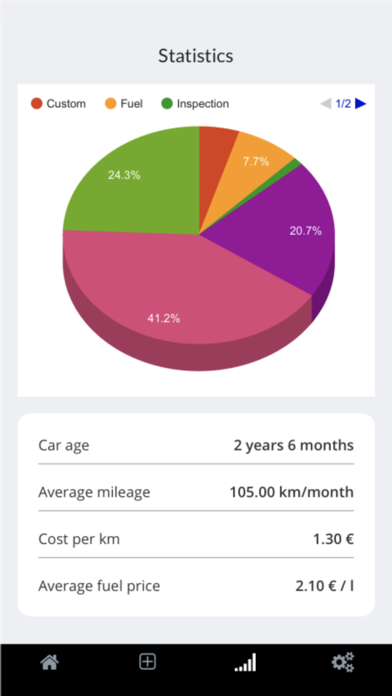

Statistics

In the statistics view you can track the car age, average monthly mileage, cost per km/mile, and average fuel cost.

Others

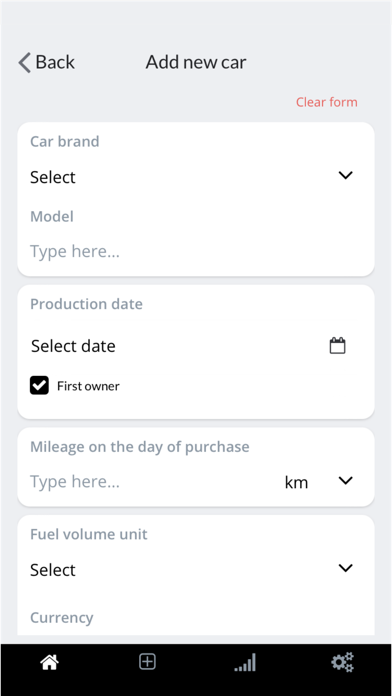

You can select your own currency, measurement unit and one of the following languages: English, Deutsch, Polski, and Español. Your car expenses data is stored in the cloud, so you can easily access your car expense data from multiple mobile devices.

Hide

Show More...