Description

This Credit Score and Credit Repair course is your opportunity to understand why and how you should handle your credit score and how to improve it by credit repair steps.

Your credit score comes with a substantial effect on your foreseeable future, however it is very likely that you don’t know enough about it.

Tips and guidelines you'll discover and precious know-how that you'll obtain here may be a lifesaver down the road. Make the effort to learn, we've aimed to keep it brief and simple to read.

A credit rating or a credit score is an assessment of the risk of a borrower, a credit score is mainly based upon credit report data usually origin from credit bureaus.

In a few brief sessions you'll discover extremely precious understanding which will certainly be worthy of your effort and time.

In this course you will learn:

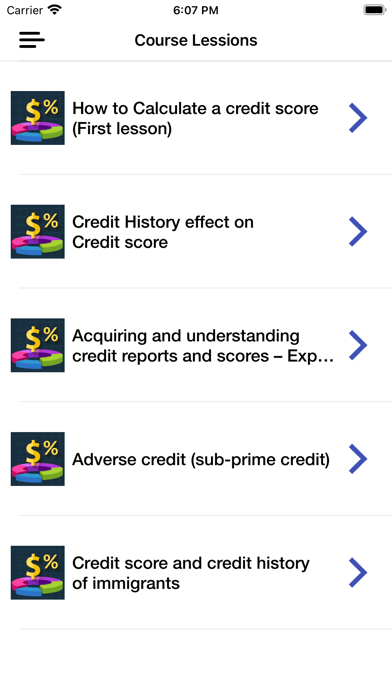

- What is the credit score, how the credit score is calculated and how to use it to your advantage. There are 6 main factors to the credit score (fico score) calculation: Payment history, Debt, Time in file, Account Diversity, The Search for a New Credit, Inquiries. We will discuss and explain each of these, they are crucial for your score maintenance and credit repair.

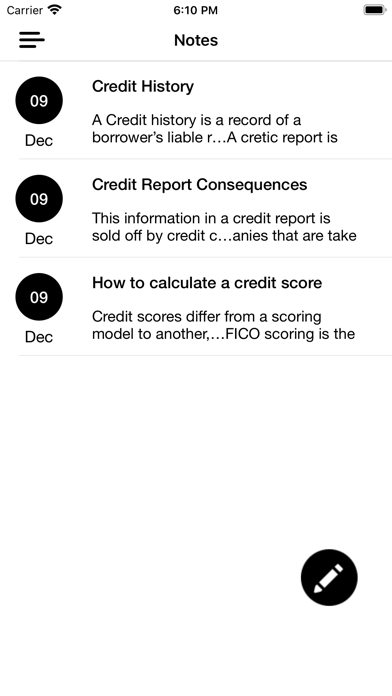

- Credit History effect on Credit score - A credit history is a record of a borrower’s liable repayment of debts. A credit report is basically a past report of the borrower’s credit history from a different variety of resources, such as banks, credit card providers, collection agencies, and state & federal governments. A borrower’s credit score is the result of an arithmetical algorithm applied to a credit report and other sources of information to predict potential misbehavior.

- Acquiring and understanding credit reports and scores – Experian, Equifax, TransUnion

People can frequently check their credit history by asking for credit reports from credit agencies and requiring correction of information if necessary.

- Adverse credit (sub-prime credit) - Unfavorable credit history, also called sub-prime credit history, non-status credit history, impaired credit history, poor credit history, and bad credit history, is a damaging credit rating.

- Credit score and credit history of immigrants - In some countries, in addition to privately owned credit agencies, credit records are also maintained by the central bank. Especially, Spain is one of those countries where the Central Credit Registers are kept by the Central Bank of Spain.

- Free annual credit report – 3 bureau credit report - Due to the FACT Law (Fair and Accurate Credit Transactions Act), each legitimate U.S. citizen is entitled to a free copy of his or her credit scores report from each credit score reporting bureau once every 12 months. The law requires all three agencies to offer reports: Equifax, Experian, and Transunion.

- Your credit score and credit report consequences - The information in a credit report is sold off by credit companies to companies that are taking into consideration whether or not to offer credit to individuals or companies. The result of a negative credit rating has likely resulted in the shape of reduction of chances that a loan provider will approve an application for credit under favorable terms, if at all. Interest rates on loans are substantially influenced by credit history.

Credit Repair - A credit score is determined also by taking into account your past record, but there are a handful of things that you can do to develop a real impact on your credit score. If you are searching for credit repair, you should consider 11 steps detailed in the guide.

Our vision is to make financial education accessible to everybody, so you have all the knowledge you need here and without charge.

Download now and take care of your finance.

Hide

Show More...

Your credit score comes with a substantial effect on your foreseeable future, however it is very likely that you don’t know enough about it.

Tips and guidelines you'll discover and precious know-how that you'll obtain here may be a lifesaver down the road. Make the effort to learn, we've aimed to keep it brief and simple to read.

A credit rating or a credit score is an assessment of the risk of a borrower, a credit score is mainly based upon credit report data usually origin from credit bureaus.

In a few brief sessions you'll discover extremely precious understanding which will certainly be worthy of your effort and time.

In this course you will learn:

- What is the credit score, how the credit score is calculated and how to use it to your advantage. There are 6 main factors to the credit score (fico score) calculation: Payment history, Debt, Time in file, Account Diversity, The Search for a New Credit, Inquiries. We will discuss and explain each of these, they are crucial for your score maintenance and credit repair.

- Credit History effect on Credit score - A credit history is a record of a borrower’s liable repayment of debts. A credit report is basically a past report of the borrower’s credit history from a different variety of resources, such as banks, credit card providers, collection agencies, and state & federal governments. A borrower’s credit score is the result of an arithmetical algorithm applied to a credit report and other sources of information to predict potential misbehavior.

- Acquiring and understanding credit reports and scores – Experian, Equifax, TransUnion

People can frequently check their credit history by asking for credit reports from credit agencies and requiring correction of information if necessary.

- Adverse credit (sub-prime credit) - Unfavorable credit history, also called sub-prime credit history, non-status credit history, impaired credit history, poor credit history, and bad credit history, is a damaging credit rating.

- Credit score and credit history of immigrants - In some countries, in addition to privately owned credit agencies, credit records are also maintained by the central bank. Especially, Spain is one of those countries where the Central Credit Registers are kept by the Central Bank of Spain.

- Free annual credit report – 3 bureau credit report - Due to the FACT Law (Fair and Accurate Credit Transactions Act), each legitimate U.S. citizen is entitled to a free copy of his or her credit scores report from each credit score reporting bureau once every 12 months. The law requires all three agencies to offer reports: Equifax, Experian, and Transunion.

- Your credit score and credit report consequences - The information in a credit report is sold off by credit companies to companies that are taking into consideration whether or not to offer credit to individuals or companies. The result of a negative credit rating has likely resulted in the shape of reduction of chances that a loan provider will approve an application for credit under favorable terms, if at all. Interest rates on loans are substantially influenced by credit history.

Credit Repair - A credit score is determined also by taking into account your past record, but there are a handful of things that you can do to develop a real impact on your credit score. If you are searching for credit repair, you should consider 11 steps detailed in the guide.

Our vision is to make financial education accessible to everybody, so you have all the knowledge you need here and without charge.

Download now and take care of your finance.

Screenshots

Credit repair & Score Check FAQ

-

Is Credit repair & Score Check free?

Yes, Credit repair & Score Check is completely free and it doesn't have any in-app purchases or subscriptions.

-

Is Credit repair & Score Check legit?

Not enough reviews to make a reliable assessment. The app needs more user feedback.

Thanks for the vote -

How much does Credit repair & Score Check cost?

Credit repair & Score Check is free.

-

What is Credit repair & Score Check revenue?

To get estimated revenue of Credit repair & Score Check app and other AppStore insights you can sign up to AppTail Mobile Analytics Platform.

User Rating

App is not rated in Slovenia yet.

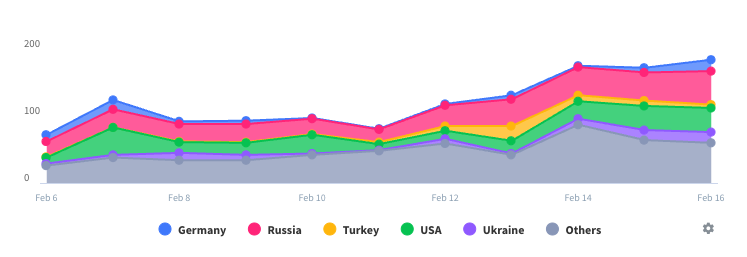

Ratings History

Credit repair & Score Check Reviews

Store Rankings

Ranking History

App Ranking History not available yet

Category Rankings

App is not ranked yet

Credit repair & Score Check Installs

Last 30 daysCredit repair & Score Check Revenue

Last 30 daysCredit repair & Score Check Revenue and Downloads

Gain valuable insights into Credit repair & Score Check performance with our analytics.

Sign up now to access downloads, revenue, and more.

Sign up now to access downloads, revenue, and more.

App Info

- Category

- Finance

- Publisher

-

yoav fael

- Languages

- English

- Recent release

- 1.0 (2 years ago )

- Released on

- Dec 10, 2022 (2 years ago )

- Also available in

- United States , Lebanon , Philippines , Peru , New Zealand , Norway , Netherlands , Nigeria , Malaysia , Mexico , Pakistan , Kazakhstan , Kuwait , South Korea , Japan , Italy , India , Israel , Poland , Portugal , Romania , Russia , Saudi Arabia , Sweden , Singapore , Slovenia , Thailand , Türkiye , Taiwan , Ukraine , Vietnam , South Africa , Denmark , Argentina , Austria , Australia , Azerbaijan , Belgium , Bulgaria , Brazil , Belarus , Canada , Switzerland , Chile , China , Colombia , Czechia , Germany , United Arab Emirates , Dominican Republic , Algeria , Ecuador , Estonia , Egypt , Spain , Finland , France , United Kingdom , Greece , Hong Kong SAR China , Hungary , Indonesia , Ireland

- Last Updated

- 2 weeks ago

This page includes copyrighted content from third parties, shared solely for commentary and research in accordance with fair use under applicable copyright laws. All trademarks, including product, service, and company names or logos, remain the property of their respective owners. Their use here falls under nominative fair use as outlined by trademark laws and does not suggest any affiliation with or endorsement by the trademark holders.