Description

This guide will help you understand payday loans (payday advance / cash advance loans) and get the most out of your situation.

To get the best results you will:

1. Use our loan calculator to simulate your loan.

2. Get the full payday advance loan guide with short easy to read lesson.

3. Tap into our live news feed.

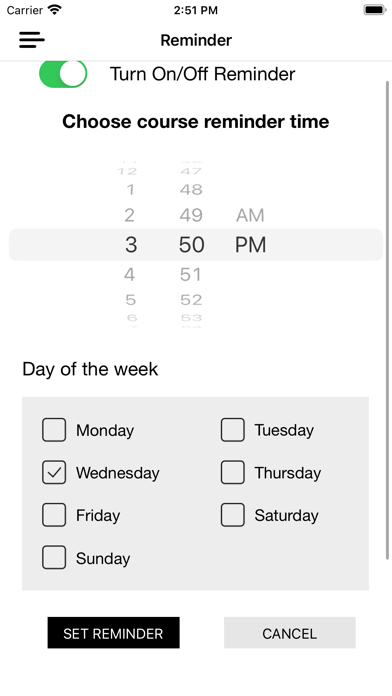

4. Use the lesson scheduling system to stay focused on getting all the knowledge you need.

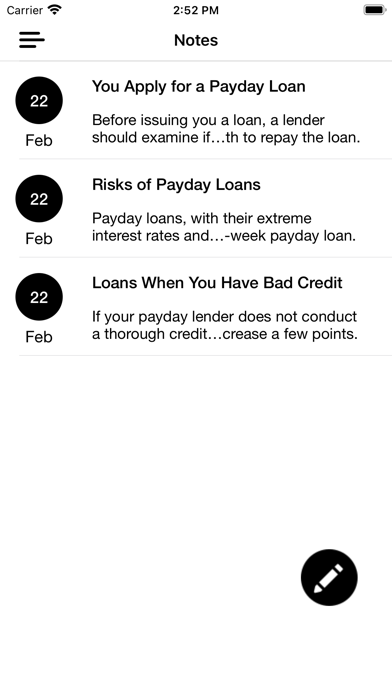

5. Use the in-app course notebook.

6. Get more tools to achieve the best results.

Payday loans are immediate loans for large amounts of money. They may be found at high-street retailers and on the internet. Payday loans are easy to get, but the interest rates are hefty. The funds are sent straight into the borrower’s bank account, where they can be spent as needed before being repaid with interest in weeks rather than months or years. Consider your other choices before borrowing from a payday lender if you have short-term money difficulty.

Before applying for a payday loan, search around and evaluate the interest rates and fees. Make sure you understand what will happen if you are unable to repay the loan.

This course explains what the borrower—you—should do before applying for a payday loan, how you repay the loan, and what happens if you are unable to pay.

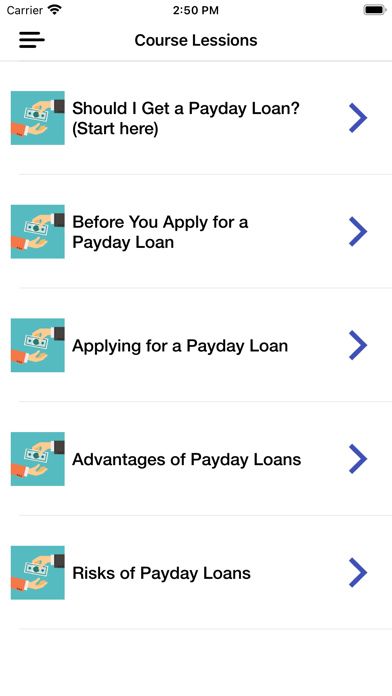

Should I Get a Payday Loan?

Your financial situation will dictate whether or not you should apply for a payday loan. If you have an unexpected bill a few days before your next paycheck and can find a payday loan that does not charge you a high-interest rate while repaying, it might be a realistic alternative.

Before You Apply for a Payday Loan

Make sure to look around for the greatest price. Online payday lenders must post their offers on at least one price comparison website so that you may compare them to others. The Financial Conduct Authority must regulate the pricing comparison service.

Applying for a Payday Loan

If you do decide to apply for a payday loan, it’s important to consider 3 main things: Be certain that you just borrow what you require, take the time to look around, Choose your lender wisely.

Advantages of Payday Loans

The most significant benefit of payday loans is the quick and easy access they provide. You may apply for a payday loan instantly online. The money will be in your bank account within minutes after being accepted for a loan.

Risks of Payday Loans

Although payday loans provide quick cash, they are not without risks.

We’ll talk about Excessive rollover fees, Risk of default, Steep borrowing costs

Payday Loans When You Have Bad Credit

Many payday lenders do not conduct any kind of credit check. They perceive that most of the customers looking for payday loans don’t have great credit. Banks make up for the expanded credit risk by charging higher financing costs and interest rates.

Paying Back a Payday Loan

Typically, you’ll be allowed up to a month to repay the loan plus interest. The most frequent method of repaying a payday loan is via a bank debit card. When you accept the loan, you agree to allow the lender to withdraw funds from your bank account. This is referred to as a continuous payment authority (CPA).

How to Cancel a Regular Payment

We will talk about Recurring payment, Standing order, Direct Debit

How to Avoid the Payday Loan Trap

On the off chance that you are experiencing issues reimbursing a payday loan, your bank might offer you an extension known as a deferral or rollover – or even another loan. However, your lender can only offer you a maximum of two rollovers.

Don’t Be Fooled by Loan Advertisements

Payday lenders promote their loans as a solution to any cash flow problem you can think of.

Alternatives to Payday Loans

You might not be able to secure a standard bank loan to fulfill your short-term financial needs, but some of these alternatives to payday loans may be more effective.

Loan Calculator

Free loan calculator for your use, use to simulate possible loans.

Hide

Show More...

To get the best results you will:

1. Use our loan calculator to simulate your loan.

2. Get the full payday advance loan guide with short easy to read lesson.

3. Tap into our live news feed.

4. Use the lesson scheduling system to stay focused on getting all the knowledge you need.

5. Use the in-app course notebook.

6. Get more tools to achieve the best results.

Payday loans are immediate loans for large amounts of money. They may be found at high-street retailers and on the internet. Payday loans are easy to get, but the interest rates are hefty. The funds are sent straight into the borrower’s bank account, where they can be spent as needed before being repaid with interest in weeks rather than months or years. Consider your other choices before borrowing from a payday lender if you have short-term money difficulty.

Before applying for a payday loan, search around and evaluate the interest rates and fees. Make sure you understand what will happen if you are unable to repay the loan.

This course explains what the borrower—you—should do before applying for a payday loan, how you repay the loan, and what happens if you are unable to pay.

Should I Get a Payday Loan?

Your financial situation will dictate whether or not you should apply for a payday loan. If you have an unexpected bill a few days before your next paycheck and can find a payday loan that does not charge you a high-interest rate while repaying, it might be a realistic alternative.

Before You Apply for a Payday Loan

Make sure to look around for the greatest price. Online payday lenders must post their offers on at least one price comparison website so that you may compare them to others. The Financial Conduct Authority must regulate the pricing comparison service.

Applying for a Payday Loan

If you do decide to apply for a payday loan, it’s important to consider 3 main things: Be certain that you just borrow what you require, take the time to look around, Choose your lender wisely.

Advantages of Payday Loans

The most significant benefit of payday loans is the quick and easy access they provide. You may apply for a payday loan instantly online. The money will be in your bank account within minutes after being accepted for a loan.

Risks of Payday Loans

Although payday loans provide quick cash, they are not without risks.

We’ll talk about Excessive rollover fees, Risk of default, Steep borrowing costs

Payday Loans When You Have Bad Credit

Many payday lenders do not conduct any kind of credit check. They perceive that most of the customers looking for payday loans don’t have great credit. Banks make up for the expanded credit risk by charging higher financing costs and interest rates.

Paying Back a Payday Loan

Typically, you’ll be allowed up to a month to repay the loan plus interest. The most frequent method of repaying a payday loan is via a bank debit card. When you accept the loan, you agree to allow the lender to withdraw funds from your bank account. This is referred to as a continuous payment authority (CPA).

How to Cancel a Regular Payment

We will talk about Recurring payment, Standing order, Direct Debit

How to Avoid the Payday Loan Trap

On the off chance that you are experiencing issues reimbursing a payday loan, your bank might offer you an extension known as a deferral or rollover – or even another loan. However, your lender can only offer you a maximum of two rollovers.

Don’t Be Fooled by Loan Advertisements

Payday lenders promote their loans as a solution to any cash flow problem you can think of.

Alternatives to Payday Loans

You might not be able to secure a standard bank loan to fulfill your short-term financial needs, but some of these alternatives to payday loans may be more effective.

Loan Calculator

Free loan calculator for your use, use to simulate possible loans.

Screenshots

Payday & Cash advance Guide FAQ

-

Is Payday & Cash advance Guide free?

Yes, Payday & Cash advance Guide is completely free and it doesn't have any in-app purchases or subscriptions.

-

Is Payday & Cash advance Guide legit?

Not enough reviews to make a reliable assessment. The app needs more user feedback.

Thanks for the vote -

How much does Payday & Cash advance Guide cost?

Payday & Cash advance Guide is free.

-

What is Payday & Cash advance Guide revenue?

To get estimated revenue of Payday & Cash advance Guide app and other AppStore insights you can sign up to AppTail Mobile Analytics Platform.

User Rating

App is not rated in Malaysia yet.

Ratings History

Payday & Cash advance Guide Reviews

No Reviews in Malaysia

App doesn't have any reviews in Malaysia yet.

Store Rankings

Ranking History

App Ranking History not available yet

Category Rankings

App is not ranked yet

Keywords

Payday & Cash advance Guide Competitors

| Name | Downloads (30d) | Monthly Revenue | Reviews | Ratings | Recent release | |

|---|---|---|---|---|---|---|

|

CloudPay NOW

|

Unlock

|

Unlock

|

0

|

|

2 months ago | |

|

Zofi Cash

Affordable Salary Advances.

|

Unlock

|

Unlock

|

0

|

|

3 years ago | |

|

Bolt Advance App

BOLT

|

Unlock

|

Unlock

|

0

|

|

10 months ago | |

|

Payday Paycheck Advance Guide

Get paid early! Payday advance

|

Unlock

|

Unlock

|

0

|

|

2 years ago | |

|

United Payday Loan

Loan for instant support

|

Unlock

|

Unlock

|

0

|

|

2 years ago | |

|

Cash Advance Loan Guide

Loan Simple Guide & Calculator

|

Unlock

|

Unlock

|

1

|

|

2 years ago | |

|

15M: Fast Instant Payday Loans

Loan App Borrow Cash Instantly

|

Unlock

|

Unlock

|

0

|

|

1 year ago | |

|

Mitro App

Your salary, whenever you need

|

Unlock

|

Unlock

|

0

|

|

6 months ago | |

|

COMPACOM - Money Borrowing App

Instant Cash Advance Loan Fast

|

Unlock

|

Unlock

|

0

|

|

7 months ago |

Payday & Cash advance Guide Installs

Last 30 daysPayday & Cash advance Guide Revenue

Last 30 daysPayday & Cash advance Guide Revenue and Downloads

Gain valuable insights into Payday & Cash advance Guide performance with our analytics.

Sign up now to access downloads, revenue, and more.

Sign up now to access downloads, revenue, and more.

App Info

- Category

- Finance

- Publisher

-

yoav fael

- Languages

- English

- Recent release

- 1.0 (1 year ago )

- Released on

- Feb 23, 2023 (1 year ago )

- Also available in

- United Arab Emirates, Philippines, Portugal, Italy, Japan, South Korea, Kuwait, Kazakhstan, Lebanon, Mexico, Malaysia, Nigeria, Netherlands, Norway, New Zealand, Iceland, Peru, Pakistan, Israel, Poland, Romania, Russia, Saudi Arabia, Sweden, Singapore, Slovenia, Thailand, Türkiye, Taiwan, Ukraine, United States, Uzbekistan, Vietnam, South Africa, Brazil, Czechia, Cyprus, Colombia, China, Chile, Switzerland, Canada, Belarus, Germany, Bulgaria, Belgium, Azerbaijan, Australia, Austria, Argentina, Armenia, India, Denmark, Dominican Republic, Algeria, Ecuador, Egypt, Spain, Finland, France, United Kingdom, Greece, Hong Kong SAR China, Croatia, Hungary, Indonesia, Ireland

- Last Updated

- 23 hours ago