Pocket VAT Calculator

Published by: The Taxback Group

Description

The Pocket VAT Calculator brought to you by Taxback International, allows you to easily calculate your potential VAT reclaim based on actual spend, expense type and country when travelling abroad.

This app will provide you with the potential VAT reclaimable after travel while also providing you with knowledgeable information in relation to a wide variety of VAT rates and distance selling thresholds globally.

Features:

VAT Calculator

View you potential VAT reclaim for each expense type

Examples

Examples of potential VAT recovery for expenses in specific countries.

VAT Rates

VAT rates and distance selling threshold reference

Contact us

Contact us for a free VAT analysis

How it works:

• By default the app will automatically select your country of origin or this can be selected manually.

• Select the country of destination along with the expense type and the amount incurred.

• Calculate your potential VAT return expense.

• Option to enter numerous lines of potential VAT returns.

• The total potential VAT Reclaim value will increase as new lines are added.

Types of expenses to choose from:

• Advertising

• Car hire

• Fuel

• Hotel

• Printing & Stationary

• Meals

• Telecoms

• Conferences

• Public Transport

Up to date VAT Rates and distance selling thresholds for the following EU and Non EU countries are available:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

This is ideal for all business people who travel abroad with work and incur large travel expenses with additional VAT added on that can be reclaimed.

Why not try it out and see if you are leaving money behind you on the table

Taxback International is a leading provider of global VAT services. We ensure international VAT compliance and maximised VAT refunds for clients of all sizes from SME’s to global organisations. Our services are streamlined, multilingual based on the latest international VAT knowledge and implemented by experienced VAT specialists. Most importantly- we ensure minimum effort from our clients whilst maximising compliance and recovery.

Hide

Show More...

This app will provide you with the potential VAT reclaimable after travel while also providing you with knowledgeable information in relation to a wide variety of VAT rates and distance selling thresholds globally.

Features:

VAT Calculator

View you potential VAT reclaim for each expense type

Examples

Examples of potential VAT recovery for expenses in specific countries.

VAT Rates

VAT rates and distance selling threshold reference

Contact us

Contact us for a free VAT analysis

How it works:

• By default the app will automatically select your country of origin or this can be selected manually.

• Select the country of destination along with the expense type and the amount incurred.

• Calculate your potential VAT return expense.

• Option to enter numerous lines of potential VAT returns.

• The total potential VAT Reclaim value will increase as new lines are added.

Types of expenses to choose from:

• Advertising

• Car hire

• Fuel

• Hotel

• Printing & Stationary

• Meals

• Telecoms

• Conferences

• Public Transport

Up to date VAT Rates and distance selling thresholds for the following EU and Non EU countries are available:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

This is ideal for all business people who travel abroad with work and incur large travel expenses with additional VAT added on that can be reclaimed.

Why not try it out and see if you are leaving money behind you on the table

Taxback International is a leading provider of global VAT services. We ensure international VAT compliance and maximised VAT refunds for clients of all sizes from SME’s to global organisations. Our services are streamlined, multilingual based on the latest international VAT knowledge and implemented by experienced VAT specialists. Most importantly- we ensure minimum effort from our clients whilst maximising compliance and recovery.

Screenshots

Pocket VAT Calculator FAQ

-

Is Pocket VAT Calculator free?

Yes, Pocket VAT Calculator is completely free and it doesn't have any in-app purchases or subscriptions.

-

Is Pocket VAT Calculator legit?

Not enough reviews to make a reliable assessment. The app needs more user feedback.

Thanks for the vote -

How much does Pocket VAT Calculator cost?

Pocket VAT Calculator is free.

-

What is Pocket VAT Calculator revenue?

To get estimated revenue of Pocket VAT Calculator app and other AppStore insights you can sign up to AppTail Mobile Analytics Platform.

User Rating

App is not rated in Türkiye yet.

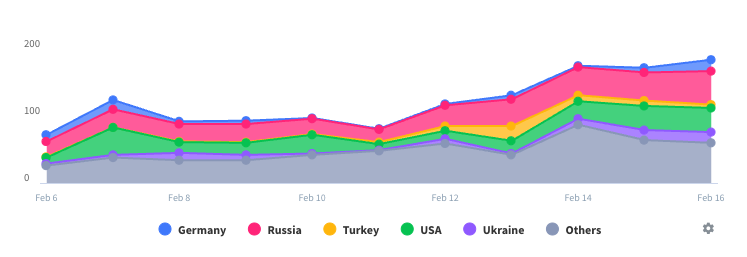

Ratings History

Pocket VAT Calculator Reviews

Store Rankings

Ranking History

App Ranking History not available yet

Category Rankings

App is not ranked yet

Pocket VAT Calculator Installs

Last 30 daysPocket VAT Calculator Revenue

Last 30 daysPocket VAT Calculator Revenue and Downloads

Gain valuable insights into Pocket VAT Calculator performance with our analytics.

Sign up now to access downloads, revenue, and more.

Sign up now to access downloads, revenue, and more.

App Info

- Category

- Finance

- Publisher

- The Taxback Group

- Languages

- English

- Recent release

- 2.1.1 (5 years ago )

- Released on

- Oct 3, 2015 (9 years ago )

- Also available in

- Ireland, Sweden, Poland, Japan, South Korea, Kuwait, Kazakhstan, Lebanon, Mexico, Malaysia, Nigeria, Netherlands, Norway, New Zealand, Peru, Philippines, Pakistan, India, Portugal, Romania, Russia, Saudi Arabia, Singapore, Thailand, Türkiye, Taiwan, Ukraine, United States, Uzbekistan, Vietnam, South Africa, Denmark, Argentina, Austria, Australia, Azerbaijan, Belgium, Brazil, Belarus, Canada, Switzerland, Chile, China, Colombia, Czechia, Germany, Italy, Dominican Republic, Algeria, Ecuador, Egypt, Spain, Finland, France, United Kingdom, Greece, Hong Kong SAR China, Hungary, Indonesia, Israel, United Arab Emirates

- Last Updated

- 2 months ago