TaxDay

Published by:

TaxDay

Description

Are you a frequent traveller? Have more than one home and travel frequently between them? Are you tracking your tax residency status?

The US tax code is over 50,000 pages long. With TaxDay, you’ll be able to easily monitor your travel with GPS against every US state residency tax code. Make filing a breeze with quick reporting and get better prepared for audits with TaxDay.

TaxDay is the perfect tool to help frequent interstate business travelers and people with multi-state residency plan and accurately track taxable days (and now includes New York City tracking!). It runs silently in the background, using your phone's GPS, and a comprehensive database of state-by-state residency tax rules, to securely track travel. And, when traveling outside the U.S., TaxDay will now track that as well, indicating the specific travel for over 150 countries countries. Smart notifications and an intuitive reporting interface make it easy to manage records and generate an accurate, complete report in case audits.

Key features include:

• At-a-glance travel summary: A “just the facts” snapshot of your travel and taxable days in any jurisdiction is at your fingertips.

• Receipt management: Attach receipts to your travel records for thorough record-keeping.

• Threshold notifications and alerts: Never risk losing track of how many days you’ve spent in a particular jurisdiction. TaxDay warns you when you’re close to triggering tax day thresholds and becoming a potential resident.

•Travel record export: Easily generate a detailed report to share with your accountant or anyone else.

Getting started is easy!

• All new TaxDay members enjoy a risk-free 45-day trial to start.

• After your trial, you can decide if you’d like to subscribe to TaxDay for $9.99 per month, billed to your iTunes Account at confirmation of purchase.

• There’s no commitment—cancel anytime.

The fine print:

• Payment will be charged to iTunes Account at confirmation of purchase.

• Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period.

• Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal.

• Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user’s Account Settings after purchase.

• Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable.

Terms & Privacy Policy: http://taxday.com/terms.html

Hide

Show More...

The US tax code is over 50,000 pages long. With TaxDay, you’ll be able to easily monitor your travel with GPS against every US state residency tax code. Make filing a breeze with quick reporting and get better prepared for audits with TaxDay.

TaxDay is the perfect tool to help frequent interstate business travelers and people with multi-state residency plan and accurately track taxable days (and now includes New York City tracking!). It runs silently in the background, using your phone's GPS, and a comprehensive database of state-by-state residency tax rules, to securely track travel. And, when traveling outside the U.S., TaxDay will now track that as well, indicating the specific travel for over 150 countries countries. Smart notifications and an intuitive reporting interface make it easy to manage records and generate an accurate, complete report in case audits.

Key features include:

• At-a-glance travel summary: A “just the facts” snapshot of your travel and taxable days in any jurisdiction is at your fingertips.

• Receipt management: Attach receipts to your travel records for thorough record-keeping.

• Threshold notifications and alerts: Never risk losing track of how many days you’ve spent in a particular jurisdiction. TaxDay warns you when you’re close to triggering tax day thresholds and becoming a potential resident.

•Travel record export: Easily generate a detailed report to share with your accountant or anyone else.

Getting started is easy!

• All new TaxDay members enjoy a risk-free 45-day trial to start.

• After your trial, you can decide if you’d like to subscribe to TaxDay for $9.99 per month, billed to your iTunes Account at confirmation of purchase.

• There’s no commitment—cancel anytime.

The fine print:

• Payment will be charged to iTunes Account at confirmation of purchase.

• Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period.

• Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal.

• Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user’s Account Settings after purchase.

• Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable.

Terms & Privacy Policy: http://taxday.com/terms.html

In-Apps

- United States

- €9.49

Screenshots

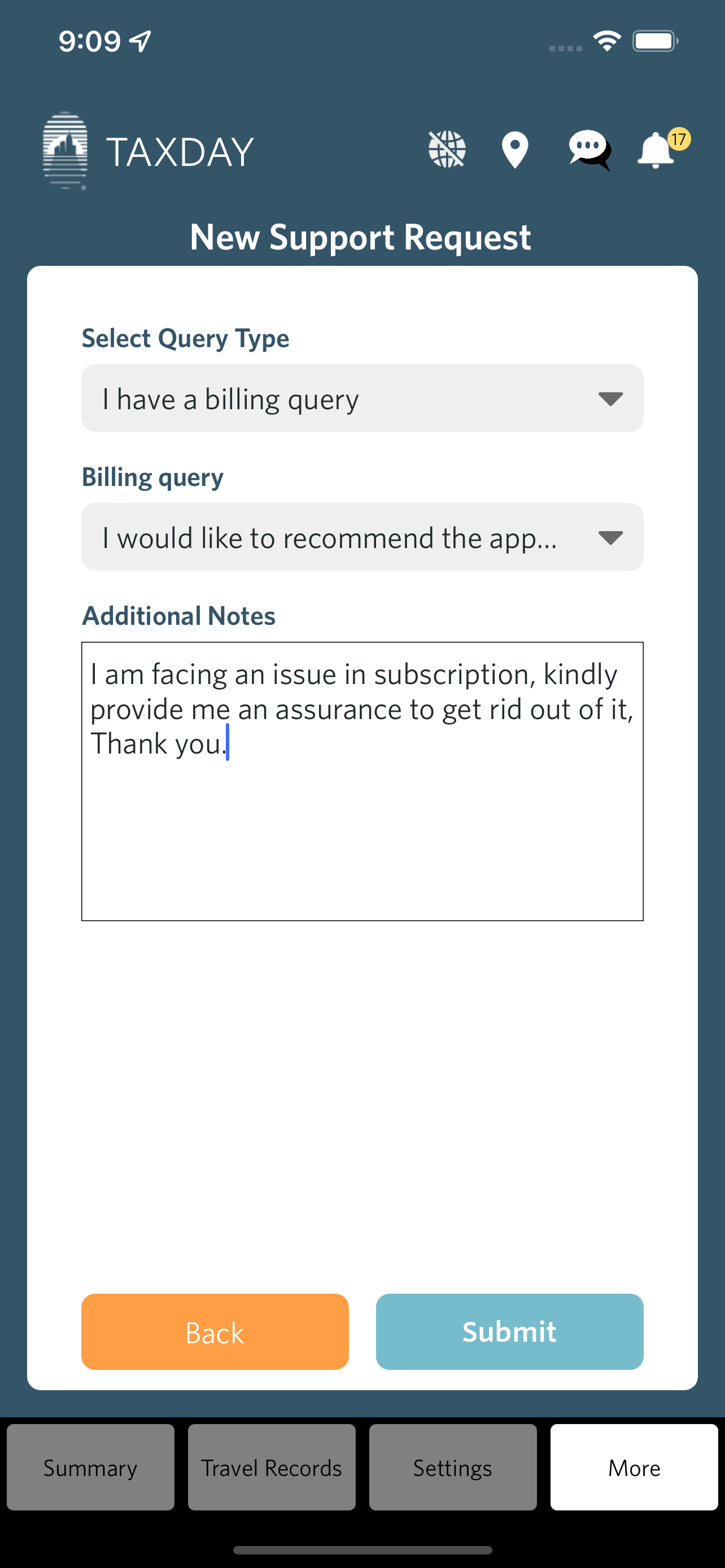

TaxDay FAQ

-

Is TaxDay free?

Yes, TaxDay is free to download, however it contains in-app purchases or subscription offerings.

-

Is TaxDay legit?

Not enough reviews to make a reliable assessment. The app needs more user feedback.

Thanks for the vote -

How much does TaxDay cost?

TaxDay has several in-app purchases/subscriptions, the average in-app price is €9.49.

-

What is TaxDay revenue?

To get estimated revenue of TaxDay app and other AppStore insights you can sign up to AppTail Mobile Analytics Platform.

User Rating

App is not rated in France yet.

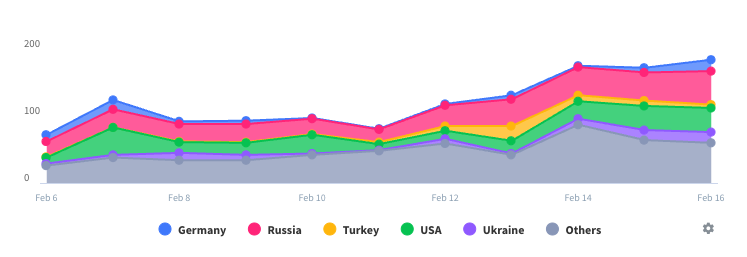

Ratings History

TaxDay Reviews

Store Rankings

Ranking History

App Ranking History not available yet

Category Rankings

|

Chart

|

Category

|

Rank

|

|---|---|---|

|

Top Grossing

|

|

82

|

TaxDay Competitors

| Name | Downloads (30d) | Monthly Revenue | Reviews | Ratings | Recent release | |

|---|---|---|---|---|---|---|

|

Chrono: Time in Place

Tax Residency + Visas + Fun

|

Unlock

|

Unlock

|

0

|

|

1 month ago | |

|

Domicile365

Track tax days

|

Unlock

|

Unlock

|

0

|

|

2 weeks ago | |

|

Monaeo

|

Unlock

|

Unlock

|

0

|

|

4 days ago | |

|

Topia Compass

|

Unlock

|

Unlock

|

0

|

|

4 days ago | |

|

TrackingStates™

US State residency day counter

|

Unlock

|

Unlock

|

0

|

|

1 month ago | |

|

Morgan Stanley Matrix

|

Unlock

|

Unlock

|

0

|

|

3 months ago | |

|

Tegus

|

Unlock

|

Unlock

|

0

|

|

3 months ago | |

|

ComplianceAlpha

|

Unlock

|

Unlock

|

0

|

|

2 weeks ago | |

|

PURE Insurance

Exclusively for PURE members.

|

Unlock

|

Unlock

|

0

|

|

5 days ago | |

The 20/22 Act Society

|

Unlock

|

Unlock

|

0

|

|

4 months ago |

TaxDay Installs

Last 30 daysTaxDay Revenue

Last 30 daysTaxDay Revenue and Downloads

Gain valuable insights into TaxDay performance with our analytics.

Sign up now to access downloads, revenue, and more.

Sign up now to access downloads, revenue, and more.

App Info

- Category

- Finance

- Publisher

-

TaxDay

- Languages

- English

- Recent release

- 1.43.2 (4 months ago )

- Released on

- Feb 2, 2017 (7 years ago )

- Also available in

- Poland , South Korea , Kuwait , Madagascar , Mexico , Malaysia , Nigeria , Netherlands , New Zealand , Peru , Philippines , Japan , Portugal , Romania , Russia , Sweden , Singapore , Thailand , Ukraine , United States , Vietnam , South Africa , Denmark , Argentina , Austria , Australia , Brazil , Canada , Switzerland , Chile , China , Czechia , Germany , United Arab Emirates , Ecuador , Spain , Finland , France , United Kingdom , Hong Kong SAR China , Indonesia , Israel , India , Italy

- Last Updated

- 2 days ago

This page includes copyrighted content from third parties, shared solely for commentary and research in accordance with fair use under applicable copyright laws. All trademarks, including product, service, and company names or logos, remain the property of their respective owners. Their use here falls under nominative fair use as outlined by trademark laws and does not suggest any affiliation with or endorsement by the trademark holders.