Maxiom Wealth Advisory

Wealth Management & Advisory

Veröffentlicht von:

SIMPLY GROW TECHNOLOGIES PRIVATE

Beschreibung

Maxiom Wealth helps you invest in top-performing stocks, mutual funds and PMS to build your financial future and achieve your life goals.

Thousands of investors across the world enjoy these benefits:

1. Invest with peace of mind, in best stocks and mutual funds guided by Roots & Wings Philosophy.

2. Investment advice is curated by a team of IIM, IIT and CA Rank holders with decades of industry experience.

3. Zero conflict of interest and zero bias. Clean operating model. We are a SEBI Registered Investment Advisory company (Type:corporate INA200015583).

—

FREE Tools:

1. Personalised financial plan to achieve all life goals (retirement, education etc).

2. Assess risk profile and identify the best investment profile for you. This can reduce risk and grow your money faster.

3. Single place to import easily and track ALL your entire stocks and mutual fund portfolio.Track assets like PPF, EPF, Real Estate, NPS too. Get a unified view, save time and effort.

4. Link investments/assets to goals to track achievement percentages.

—

Ram Kalyan Medury (founder) says:

"We started Maxiom Wealth to make investing transparent. As investors we found that wrong products were being pushed with high indirect costs.

Avoiding untrustworthy promoters/middlemen helps invest in high quality stocks and funds.

Reducing the effect of emotions using technology helps preserve wealth by reducing drawdowns when markets are choppy.

Prosperity is inevitable when people are confident to stay invested in good equities over longer time frames. Our models enable this."

—

Roots & Wings Investment Philosophy:

Maxiom follows an Investment Philosophy called Roots & Wings. A team of industry experts having 30+ years experience in advisory & research carefully selects stock portfolios. They are aided by machine learning algorithms and operate with a transparent model without any hidden brokerages or commissions.

Roots:

Roots aim to preserve wealth by selecting companies with low debt, consistent ROE/ROCE & promoter integrity. We prefer to invest in businesses that carry very low debt. This means that their growth is fuelled by their customers and through internal accruals. We like companies that consistently reward their shareholders through high levels of Return on Equity, Return on Capital Employed and Return on Assets. This signals not only an efficient business but also one that is shareholder friendly. We like promoters who demonstrate both skin-in-the-game and

soul-in-the-game. Such promoters retain significant ownership in their business, which prevents the ‘agency problem’.

Wings:

Wings aim to increase prosperity by identifying growing companies (sales/profit/cash flows) that are resilient and have pricing and staying power in their markets. We like companies that have a huge runway of growth ahead of them. Usually they tend to grow 1.5 to 3 x times that of the GDP Growth. We prefer companies that possess significant operating cash flows. This also indicates that their growth is real, and not manufactured. Companies that are dominant in their markets and continue to hold good Market Share are preferred.

Investment Process:

Buying and forgetting, or just sitting tight, is a luxury that the smart investor cannot afford. We grill each stock with an intense review process that periodically checks for all the fundamentals. The model clinically picks early indicators which help exit risky stocks in time. To err on the side of caution is preferable to losing hard-earned capital. The investment philosophy is fully backed up by a system that takes emotion out of the picture, leading to balanced decisions which augur well for the portfolio.

Our Integrations: BSE Star transaction platform, AMFI, BSE, NSE (Portfolio feeds), Digio for eSign, K Fintech and Digio for eKYC. Cashfree for payment gateway. Most established brokers like Zerodha, Upstox, HDFC, ICICI Direct, Axis Direct, etc. For our PMS, ICICI Bank and Nuvama provide custodian services.

Happy Investing!

Ausblenden

Mehr anzeigen...

Thousands of investors across the world enjoy these benefits:

1. Invest with peace of mind, in best stocks and mutual funds guided by Roots & Wings Philosophy.

2. Investment advice is curated by a team of IIM, IIT and CA Rank holders with decades of industry experience.

3. Zero conflict of interest and zero bias. Clean operating model. We are a SEBI Registered Investment Advisory company (Type:corporate INA200015583).

—

FREE Tools:

1. Personalised financial plan to achieve all life goals (retirement, education etc).

2. Assess risk profile and identify the best investment profile for you. This can reduce risk and grow your money faster.

3. Single place to import easily and track ALL your entire stocks and mutual fund portfolio.Track assets like PPF, EPF, Real Estate, NPS too. Get a unified view, save time and effort.

4. Link investments/assets to goals to track achievement percentages.

—

Ram Kalyan Medury (founder) says:

"We started Maxiom Wealth to make investing transparent. As investors we found that wrong products were being pushed with high indirect costs.

Avoiding untrustworthy promoters/middlemen helps invest in high quality stocks and funds.

Reducing the effect of emotions using technology helps preserve wealth by reducing drawdowns when markets are choppy.

Prosperity is inevitable when people are confident to stay invested in good equities over longer time frames. Our models enable this."

—

Roots & Wings Investment Philosophy:

Maxiom follows an Investment Philosophy called Roots & Wings. A team of industry experts having 30+ years experience in advisory & research carefully selects stock portfolios. They are aided by machine learning algorithms and operate with a transparent model without any hidden brokerages or commissions.

Roots:

Roots aim to preserve wealth by selecting companies with low debt, consistent ROE/ROCE & promoter integrity. We prefer to invest in businesses that carry very low debt. This means that their growth is fuelled by their customers and through internal accruals. We like companies that consistently reward their shareholders through high levels of Return on Equity, Return on Capital Employed and Return on Assets. This signals not only an efficient business but also one that is shareholder friendly. We like promoters who demonstrate both skin-in-the-game and

soul-in-the-game. Such promoters retain significant ownership in their business, which prevents the ‘agency problem’.

Wings:

Wings aim to increase prosperity by identifying growing companies (sales/profit/cash flows) that are resilient and have pricing and staying power in their markets. We like companies that have a huge runway of growth ahead of them. Usually they tend to grow 1.5 to 3 x times that of the GDP Growth. We prefer companies that possess significant operating cash flows. This also indicates that their growth is real, and not manufactured. Companies that are dominant in their markets and continue to hold good Market Share are preferred.

Investment Process:

Buying and forgetting, or just sitting tight, is a luxury that the smart investor cannot afford. We grill each stock with an intense review process that periodically checks for all the fundamentals. The model clinically picks early indicators which help exit risky stocks in time. To err on the side of caution is preferable to losing hard-earned capital. The investment philosophy is fully backed up by a system that takes emotion out of the picture, leading to balanced decisions which augur well for the portfolio.

Our Integrations: BSE Star transaction platform, AMFI, BSE, NSE (Portfolio feeds), Digio for eSign, K Fintech and Digio for eKYC. Cashfree for payment gateway. Most established brokers like Zerodha, Upstox, HDFC, ICICI Direct, Axis Direct, etc. For our PMS, ICICI Bank and Nuvama provide custodian services.

Happy Investing!

Screenshots

Maxiom Wealth Advisory Häufige Fragen

-

Ist Maxiom Wealth Advisory kostenlos?

Ja, Maxiom Wealth Advisory ist komplett kostenlos und enthält keine In-App-Käufe oder Abonnements.

-

Ist Maxiom Wealth Advisory seriös?

Nicht genügend Bewertungen, um eine zuverlässige Einschätzung vorzunehmen. Die App benötigt mehr Nutzerfeedback.

Danke für die Stimme -

Wie viel kostet Maxiom Wealth Advisory?

Maxiom Wealth Advisory ist kostenlos.

-

Wie hoch ist der Umsatz von Maxiom Wealth Advisory?

Um geschätzte Einnahmen der Maxiom Wealth Advisory-App und weitere AppStore-Einblicke zu erhalten, können Sie sich bei der AppTail Mobile Analytics Platform anmelden.

Benutzerbewertung

Die App ist in Indien noch nicht bewertet.

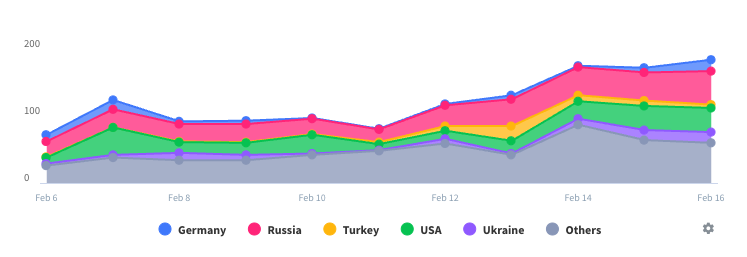

Bewertungsverlauf

Maxiom Wealth Advisory Bewertungen

Keine Bewertungen in Indien

Die App hat noch keine Bewertungen in Indien.

Store-Rankings

Ranking-Verlauf

App-Ranking-Verlauf noch nicht verfügbar

Kategorien-Rankings

App ist noch nicht gerankt

Maxiom Wealth Advisory Installationen

Letzte 30 TageMaxiom Wealth Advisory Umsatz

Letzte 30 TageMaxiom Wealth Advisory Einnahmen und Downloads

Gewinnen Sie wertvolle Einblicke in die Leistung von Maxiom Wealth Advisory mit unserer Analytik.

Melden Sie sich jetzt an, um Zugriff auf Downloads, Einnahmen und mehr zu erhalten.

Melden Sie sich jetzt an, um Zugriff auf Downloads, Einnahmen und mehr zu erhalten.

App-Informationen

- Kategorie

- Finance

- Herausgeber

- SIMPLY GROW TECHNOLOGIES PRIVATE

- Sprachen

- English

- Letzte Veröffentlichung

- 3.0.8 (vor 2 Wochen )

- Veröffentlicht am

- Nov 15, 2022 (vor 2 Jahren )

- Auch verfügbar in

- Pakistan, Italien, Japan, Südkorea, Kuwait, Kasachstan, Libanon, Sri Lanka, Mexiko, Malaysia, Nigeria, Niederlande, Norwegen, Neuseeland, Peru, Philippinen, Island, Polen, Portugal, Rumänien, Russland, Saudi-Arabien, Schweden, Singapur, Thailand, Türkei, Taiwan, Ukraine, Vereinigte Staaten, Usbekistan, Vietnam, Südafrika, Dominikanische Republik, Argentinien, Österreich, Australien, Aserbaidschan, Belgien, Brasilien, Belarus, Kanada, Schweiz, Chile, China, Kolumbien, Tschechien, Deutschland, Dänemark, Vereinigte Arabische Emirate, Algerien, Ecuador, Ägypten, Spanien, Finnland, Frankreich, Vereinigtes Königreich, Griechenland, Sonderverwaltungsregion Hongkong, Kroatien, Ungarn, Indonesien, Irland, Israel, Indien

- Zuletzt aktualisiert

- vor 2 Tagen

This page includes copyrighted content from third parties, shared solely for commentary and research in accordance with fair use under applicable copyright laws. All trademarks, including product, service, and company names or logos, remain the property of their respective owners. Their use here falls under nominative fair use as outlined by trademark laws and does not suggest any affiliation with or endorsement by the trademark holders.

- © 2025 AppTail.

- Unterstützung

- Privacy

- Terms

- All Apps