Great premise, poorly executed

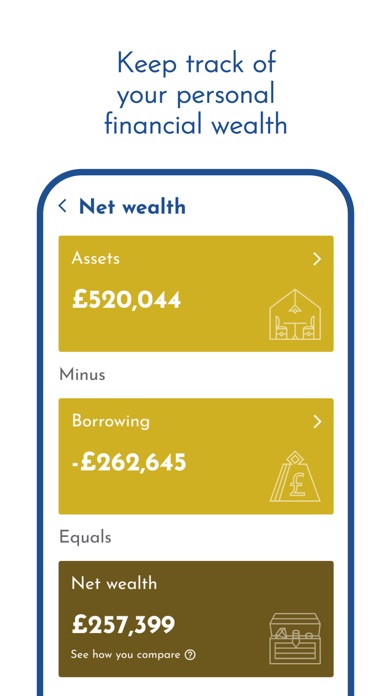

I desperately wanted to make use of this app but it is unfortunately riddled with issues during the account connection process. Firstly, the app doesn’t make use of other installed financial apps (e.g. Barclays, Monzo etc) to authorise the open banking request. This makes it an incredibly manual process to dig out usernames, account numbers, passwords and memorable information and so on. Other apps simply open the related bank’s app and asks for confirmed sharing. Secondly, there are a number of providers who simply hit errors when trying to connect accounts with the app (MBNA as an example) Thirdly, the app performance itself is incredibly inconsistent, with slow loading times, false error messages and prompts for reconnection immediately after first connecting. In short, needs a lot of work to be considered a useful financial planning app, and I hope it gets sorted quickly.