App ist vorübergehend nicht verfügbar

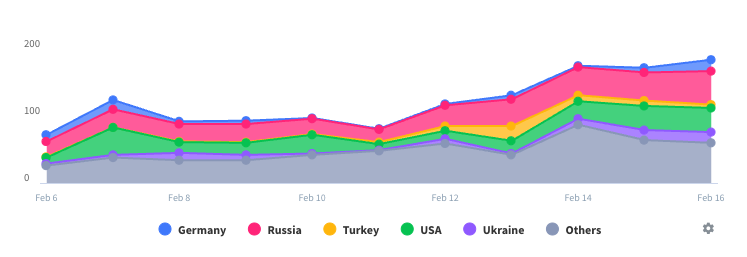

Downloads

Umsatz

Beschreibung

Tax2290 eFile is an app to prepare and report Federal Vehicle Use Tax returns with the IRS. Powered by TaxExcise and a product of ThinkTrade Inc.

Tax2290 app supports truckers to prepare and report heavy vehicle use taxes electronically, receive back the IRS Stamped Schedule-1 “Proof for 2290 payment” acknowledgement immediately once IRS accepts your return – Guaranteed!

Tax2290 ease your 2290 tax preparations and reporting with accurate tax math, simple steps, secured and safe filing.

Use this Tax2290 eFile app you can report:

· Form 2290, Vehicle Use Tax Return

· Form 2290, VIN Correction E-file

· Form 2290, Tax Amendments

· Form 2290, Tax Refund Claims

One app to report all your 2290 needs!

Tax Form 2290

The Federal Heavy Highway Vehicle Use Tax returns are reported and paid to the IRS using Form 2290. This is filed for a tax year starting from July 1 of current year through June 30 of the following year. Usually form 2290 is reported between July 1 to August 31 based on the first used month. The heavy vehicles with a taxable gross weight of 55,000 pounds or more qualify for 2290 taxes. Also when it is operated 5,000 miles (7,500 miles for Farming Vehicles) on a public highway 2290 taxes has to be reported and paid in full. This is an annual tax and paid in advance to the IRS. Form 2290 can be prepared and reported online using Tax2290 App.

Watermarked Schedule 1 Proof in Minutes.

When you efile 2290 federal vehicle use tax returns the IRS watermarked Schedule 1 proof of payment could be received in just minutes once IRS completes processing your return. This proof of payment can be used as a valid document to register your vehicles with the state authorities. Electronic filing is the fastest way to receive the Schedule 1 proof receipt.

Partial Period or Pro Rated 2290 Tax

Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins July 1, and ends June 30, must be filed by the last day of the month following the month of first use, if you first use multiple vehicles in more than one month, then a separate Form 2290 must be filed for each month. When the first used month is later to then July pro rated tax is paid based on the first used month.

Support and Help Desk

Tax2290 help desk available to help you through the filing process at 866 - 245 - 3918 or write to us at [email protected].

Ausblenden

Mehr anzeigen...

Tax2290 app supports truckers to prepare and report heavy vehicle use taxes electronically, receive back the IRS Stamped Schedule-1 “Proof for 2290 payment” acknowledgement immediately once IRS accepts your return – Guaranteed!

Tax2290 ease your 2290 tax preparations and reporting with accurate tax math, simple steps, secured and safe filing.

Use this Tax2290 eFile app you can report:

· Form 2290, Vehicle Use Tax Return

· Form 2290, VIN Correction E-file

· Form 2290, Tax Amendments

· Form 2290, Tax Refund Claims

One app to report all your 2290 needs!

Tax Form 2290

The Federal Heavy Highway Vehicle Use Tax returns are reported and paid to the IRS using Form 2290. This is filed for a tax year starting from July 1 of current year through June 30 of the following year. Usually form 2290 is reported between July 1 to August 31 based on the first used month. The heavy vehicles with a taxable gross weight of 55,000 pounds or more qualify for 2290 taxes. Also when it is operated 5,000 miles (7,500 miles for Farming Vehicles) on a public highway 2290 taxes has to be reported and paid in full. This is an annual tax and paid in advance to the IRS. Form 2290 can be prepared and reported online using Tax2290 App.

Watermarked Schedule 1 Proof in Minutes.

When you efile 2290 federal vehicle use tax returns the IRS watermarked Schedule 1 proof of payment could be received in just minutes once IRS completes processing your return. This proof of payment can be used as a valid document to register your vehicles with the state authorities. Electronic filing is the fastest way to receive the Schedule 1 proof receipt.

Partial Period or Pro Rated 2290 Tax

Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins July 1, and ends June 30, must be filed by the last day of the month following the month of first use, if you first use multiple vehicles in more than one month, then a separate Form 2290 must be filed for each month. When the first used month is later to then July pro rated tax is paid based on the first used month.

Support and Help Desk

Tax2290 help desk available to help you through the filing process at 866 - 245 - 3918 or write to us at [email protected].

Screenshots

Tax2290 eFile Häufige Fragen

-

Ist Tax2290 eFile kostenlos?

Ja, Tax2290 eFile ist komplett kostenlos und enthält keine In-App-Käufe oder Abonnements.

-

Ist Tax2290 eFile seriös?

Nicht genügend Bewertungen, um eine zuverlässige Einschätzung vorzunehmen. Die App benötigt mehr Nutzerfeedback.

Danke für die Stimme -

Wie viel kostet Tax2290 eFile?

Tax2290 eFile ist kostenlos.

-

Wie hoch ist der Umsatz von Tax2290 eFile?

Um geschätzte Einnahmen der Tax2290 eFile-App und weitere AppStore-Einblicke zu erhalten, können Sie sich bei der AppTail Mobile Analytics Platform anmelden.

Benutzerbewertung

Die App ist in Malaysia noch nicht bewertet.

Bewertungsverlauf

Tax2290 eFile Bewertungen

Keine Bewertungen in Malaysia

Die App hat noch keine Bewertungen in Malaysia.

Tax2290 eFile Installationen

Letzte 30 TageTax2290 eFile Umsatz

Letzte 30 TageTax2290 eFile Einnahmen und Downloads

Gewinnen Sie wertvolle Einblicke in die Leistung von Tax2290 eFile mit unserer Analytik.

Melden Sie sich jetzt an, um Zugriff auf Downloads, Einnahmen und mehr zu erhalten.

Melden Sie sich jetzt an, um Zugriff auf Downloads, Einnahmen und mehr zu erhalten.

App-Informationen

- Kategorie

- Finance

- Herausgeber

- ThinkTrade

- Sprachen

- English

- Letzte Veröffentlichung

- 1.6 (vor 2 Jahren )

- Veröffentlicht am

- Aug 18, 2019 (vor 5 Jahren )

- Auch verfügbar in

- Vereinigte Staaten , Pakistan , Kuwait , Kasachstan , Libanon , Mexiko , Malaysia , Niederlande , Neuseeland , Philippinen , Japan , Polen , Singapur , Türkei , Taiwan , Ukraine , Vietnam , Südafrika , Dänemark , Australien , Belgien , Brasilien , Belarus , Kanada , Schweiz , China , Tschechien , Österreich , Ägypten , Spanien , Frankreich , Vereinigtes Königreich , Griechenland , Ungarn , Indonesien , Israel

- Zuletzt aktualisiert

- vor 11 Monaten

This page includes copyrighted content from third parties, shared solely for commentary and research in accordance with fair use under applicable copyright laws. All trademarks, including product, service, and company names or logos, remain the property of their respective owners. Their use here falls under nominative fair use as outlined by trademark laws and does not suggest any affiliation with or endorsement by the trademark holders.

- © 2024 AppTail.

- Unterstützung

- Privacy

- Terms

- All Apps