Description

OVERVIEW:

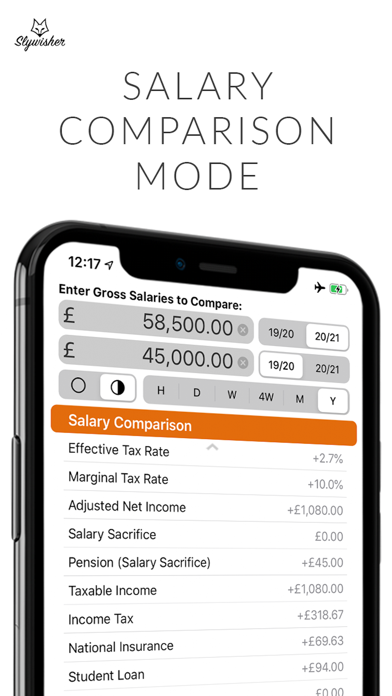

UK Salary Calculator provides a simple numerical breakdown of your PAYE income, or a comparison of two different salaries. It is intended for use by residents, employers, and job seekers in the United Kingdom. Also available for MacOS.

FEATURES:

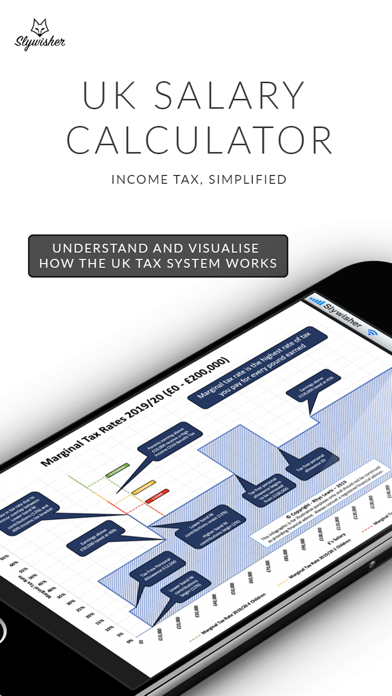

Yearly, monthly, 4-weekly, weekly, daily and hourly breakdown of income tax, national insurance contributions, pension contributions, student loan, employer's national insurance contributions, company car tax, fuel benefit charge, child benefit, high income child benefit tax, gross salary and net salary. It calculates your overall effective tax rate and your marginal tax rate (the rate at which your next pound of earnings will be taxed at). The app is also compatible with the Scottish income tax system and accommodates the 6-tier tax rate structure.

It calculates your default tax allowance based on your age & income, and has facilities for adding additional allowances, customising student loan thresholds, adding salary sacrifices, modifying the numbers of days & hours you work, adding in childcare vouchers, marriage allowances, custom tax codes & deductions. It automatically reduces your personal allowance if you earn above the £100k income threshold.

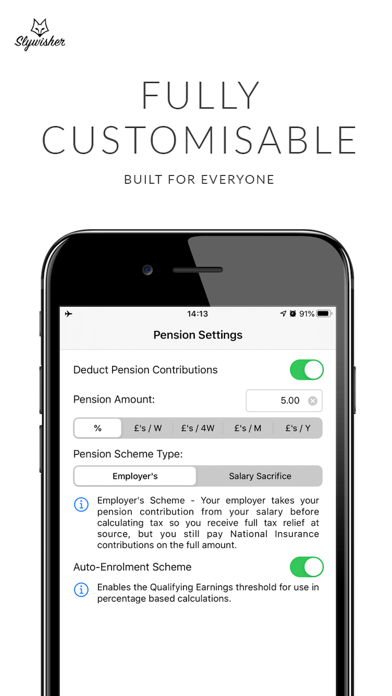

UK Salary Calculator is fully reversible, meaning you can either enter your gross salary to see what your pay will be after deductions, or you can enter a net salary that you'd like to be your take home pay and UK Salary Calculator will tell you what you need to earn as a gross wage to make that happen. This app is therefore perfect for nannies, or individuals who employ a nanny, given their typical net-pay arrangements. It also caters for auto-enrolment pensions and has a setting to enable the lower/qualifying earnings limit threshold.

It is useful for employees and employers alike; whether you are looking to check your pay packet to ensure it's right, or to see what your earnings should/could be. It is also useful to see what your take home earnings will be in the next financial year or in another job. All calculations are based on data provided by HMRC and the Student Loan Company.

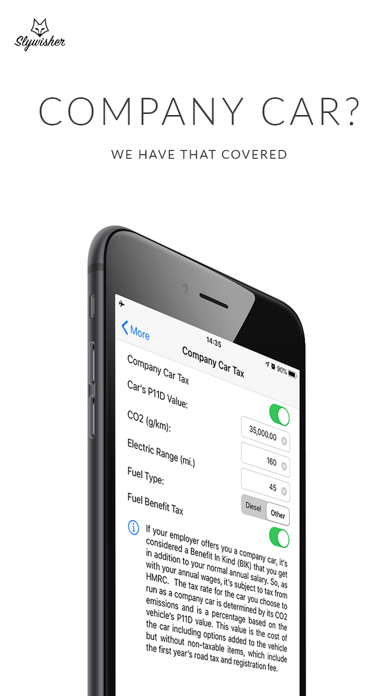

The company car tax feature allows you to input your car's P11D value & CO2 emissions and the app will automatically calculate the appropriate tax deductions and fuel benefit charge, if required.

Salary sacrifices, allowances, and deductions can be input on a £'s/Year, £'s/Month, £'s/4-Week or £'s/Week basis. Pension can be added as a percentage or an amount.

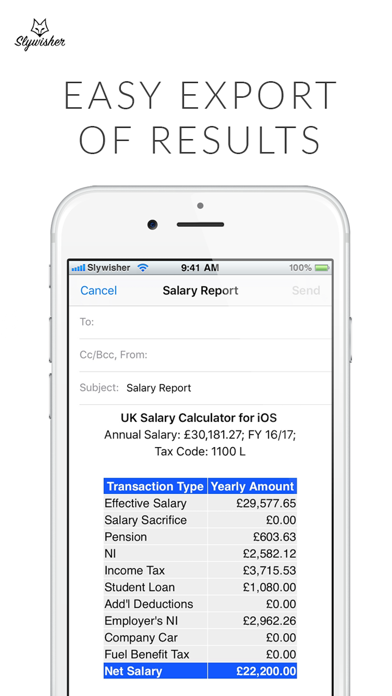

Results are easily shared and exported via email.

SUPPORTED TAX YEARS:

- 2023/2024

- 2024/2025

PROFESSIONAL EDITION TERMS & CONDITIONS

If you decide to subscribe to the Professional Edition using an auto-renewable subscription, your subscription will be valid for 12 months. A lifetime licence (one-off purchase) is also available as an alternative to an annual subscription option. The Professional Edition is advert-free, and enables more features, such as saving of your settings.

The price of the subscription is clearly advertised during the purchasing process. You are under no obligation to purchase this service. Payment will be charged to your iTunes Account at the time of purchase if you choose to subscribe.

For annual subscriptions, your subscription will automatically renew unless auto-renewal is turned off at least 24-hours before the end of the current period. Your account will be charged for renewal within 24-hours prior to the end of the current period, at the current price and currency of the subscription for your region.

Subscriptions may be managed by you at any time and auto-renewal may be turned off by going to your Account Settings after purchase.

Our privacy policy and terms of use can be found at www.slywisher.co.uk/privacy-policy.html

This app is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice.

For all other queries, I can be contacted via my website at www.slywisher.co.uk

Hide

Show More...

UK Salary Calculator provides a simple numerical breakdown of your PAYE income, or a comparison of two different salaries. It is intended for use by residents, employers, and job seekers in the United Kingdom. Also available for MacOS.

FEATURES:

Yearly, monthly, 4-weekly, weekly, daily and hourly breakdown of income tax, national insurance contributions, pension contributions, student loan, employer's national insurance contributions, company car tax, fuel benefit charge, child benefit, high income child benefit tax, gross salary and net salary. It calculates your overall effective tax rate and your marginal tax rate (the rate at which your next pound of earnings will be taxed at). The app is also compatible with the Scottish income tax system and accommodates the 6-tier tax rate structure.

It calculates your default tax allowance based on your age & income, and has facilities for adding additional allowances, customising student loan thresholds, adding salary sacrifices, modifying the numbers of days & hours you work, adding in childcare vouchers, marriage allowances, custom tax codes & deductions. It automatically reduces your personal allowance if you earn above the £100k income threshold.

UK Salary Calculator is fully reversible, meaning you can either enter your gross salary to see what your pay will be after deductions, or you can enter a net salary that you'd like to be your take home pay and UK Salary Calculator will tell you what you need to earn as a gross wage to make that happen. This app is therefore perfect for nannies, or individuals who employ a nanny, given their typical net-pay arrangements. It also caters for auto-enrolment pensions and has a setting to enable the lower/qualifying earnings limit threshold.

It is useful for employees and employers alike; whether you are looking to check your pay packet to ensure it's right, or to see what your earnings should/could be. It is also useful to see what your take home earnings will be in the next financial year or in another job. All calculations are based on data provided by HMRC and the Student Loan Company.

The company car tax feature allows you to input your car's P11D value & CO2 emissions and the app will automatically calculate the appropriate tax deductions and fuel benefit charge, if required.

Salary sacrifices, allowances, and deductions can be input on a £'s/Year, £'s/Month, £'s/4-Week or £'s/Week basis. Pension can be added as a percentage or an amount.

Results are easily shared and exported via email.

SUPPORTED TAX YEARS:

- 2023/2024

- 2024/2025

PROFESSIONAL EDITION TERMS & CONDITIONS

If you decide to subscribe to the Professional Edition using an auto-renewable subscription, your subscription will be valid for 12 months. A lifetime licence (one-off purchase) is also available as an alternative to an annual subscription option. The Professional Edition is advert-free, and enables more features, such as saving of your settings.

The price of the subscription is clearly advertised during the purchasing process. You are under no obligation to purchase this service. Payment will be charged to your iTunes Account at the time of purchase if you choose to subscribe.

For annual subscriptions, your subscription will automatically renew unless auto-renewal is turned off at least 24-hours before the end of the current period. Your account will be charged for renewal within 24-hours prior to the end of the current period, at the current price and currency of the subscription for your region.

Subscriptions may be managed by you at any time and auto-renewal may be turned off by going to your Account Settings after purchase.

Our privacy policy and terms of use can be found at www.slywisher.co.uk/privacy-policy.html

This app is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice.

For all other queries, I can be contacted via my website at www.slywisher.co.uk

In-Apps

- Professional Edition

- $5.99

Screenshots

UK Salary Calculator 2024/25 FAQ

-

Is UK Salary Calculator 2024/25 free?

Yes, UK Salary Calculator 2024/25 is free to download, however it contains in-app purchases or subscription offerings.

-

Is UK Salary Calculator 2024/25 legit?

Not enough reviews to make a reliable assessment. The app needs more user feedback.

Thanks for the vote -

How much does UK Salary Calculator 2024/25 cost?

UK Salary Calculator 2024/25 has several in-app purchases/subscriptions, the average in-app price is $5.99.

-

What is UK Salary Calculator 2024/25 revenue?

To get estimated revenue of UK Salary Calculator 2024/25 app and other AppStore insights you can sign up to AppTail Mobile Analytics Platform.

User Rating

App is not rated in Chile yet.

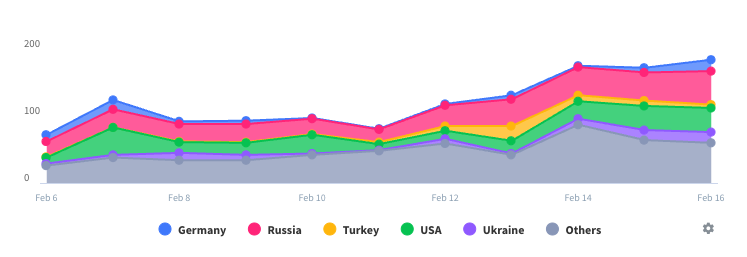

Ratings History

UK Salary Calculator 2024/25 Reviews

Store Rankings

Ranking History

App Ranking History not available yet

Category Rankings

App is not ranked yet

UK Salary Calculator 2024/25 Competitors

| Name | Downloads (30d) | Monthly Revenue | Reviews | Ratings | Recent release | |

|---|---|---|---|---|---|---|

|

UK Salary Calculator 2024-2025

|

Unlock

|

Unlock

|

0

|

|

8 months ago | |

|

UK Tax Calculators 2024-2025

Calculate Tax On Any Income

|

Unlock

|

Unlock

|

0

|

|

11 months ago | |

|

Take Home Pay

UK Salary & Tax Calculator

|

Unlock

|

Unlock

|

0

|

|

2 years ago | |

|

Track My Pension

|

Unlock

|

Unlock

|

0

|

|

5 months ago | |

|

Salary Calculator UK

Your tax, income & deductions

|

Unlock

|

Unlock

|

0

|

|

3 months ago | |

|

MoneySavingExpert

Martin Lewis’ site in an app

|

Unlock

|

Unlock

|

0

|

|

3 weeks ago | |

|

Precisionpay Go

|

Unlock

|

Unlock

|

0

|

|

4 weeks ago | |

|

KMoney Transfer

Reliable Money Remittance

|

Unlock

|

Unlock

|

0

|

|

7 months ago | |

|

Cuco

Currency Converter

|

Unlock

|

Unlock

|

0

|

|

3 years ago | |

|

HMRC Tax Calculator for UK

|

Unlock

|

Unlock

|

0

|

|

11 months ago |

UK Salary Calculator 2024/25 Installs

Last 30 daysUK Salary Calculator 2024/25 Revenue

Last 30 daysUK Salary Calculator 2024/25 Revenue and Downloads

Gain valuable insights into UK Salary Calculator 2024/25 performance with our analytics.

Sign up now to access downloads, revenue, and more.

Sign up now to access downloads, revenue, and more.

App Info

- Category

- Finance

- Publisher

-

Rhys Lewis

- Languages

- English

- Recent release

- 4.2 (8 months ago )

- Released on

- Dec 30, 2014 (10 years ago )

- Also available in

- United Kingdom , South Africa , United Arab Emirates , United States , Poland , Nigeria , Italy , Spain , Türkiye , Canada , Sri Lanka , Kuwait , South Korea , Austria , Australia , India , Netherlands , Greece , France , Pakistan , Romania , Brazil , China , Norway , Taiwan , Mexico , Malaysia , Thailand , Singapore , Vietnam , Sweden , Saudi Arabia , Iceland , Nepal , New Zealand , Peru , Russia , Uzbekistan , Philippines , Ukraine , Portugal , Dominican Republic , Argentina , Azerbaijan , Belgium , Bahrain , Brunei , Belarus , Switzerland , Chile , Colombia , Czechia , Germany , Denmark , Madagascar , Algeria , Ecuador , Egypt , Finland , Hong Kong SAR China , Hungary , Indonesia , Ireland , Israel , Japan , Kazakhstan , Lebanon

- Last Updated

- 1 month ago

This page includes copyrighted content from third parties, shared solely for commentary and research in accordance with fair use under applicable copyright laws. All trademarks, including product, service, and company names or logos, remain the property of their respective owners. Their use here falls under nominative fair use as outlined by trademark laws and does not suggest any affiliation with or endorsement by the trademark holders.