Description

From getting your credit score to tailored credit tips and advice, Up Credit is the app for you! Not only do we offer Equifax credit reports, we also offer Transunion and Experian credit reports too. Sign up today and start finding out what a best-in-class credit app should look like.

Up Credit is not only easy to use but it also provides you with insight on important factors that go into your credit score. For all the people who already have good credit this will help you to check your credit score, send you alerts when your credit score goes up or down and give you detailed access into your credit report.

UP CREDIT FEATURES

• Credit Score - Find out what goes into your credit score, what affects it, and what you can do to make it better.

• Credit Report - Take a closer look at each item in your credit report to get a better idea of what's going on with each account individually.

• 3 Bureau Credit Report* - Get your 3 bureau credit report. This will feature a report from Equifax, Experian and Transunion.

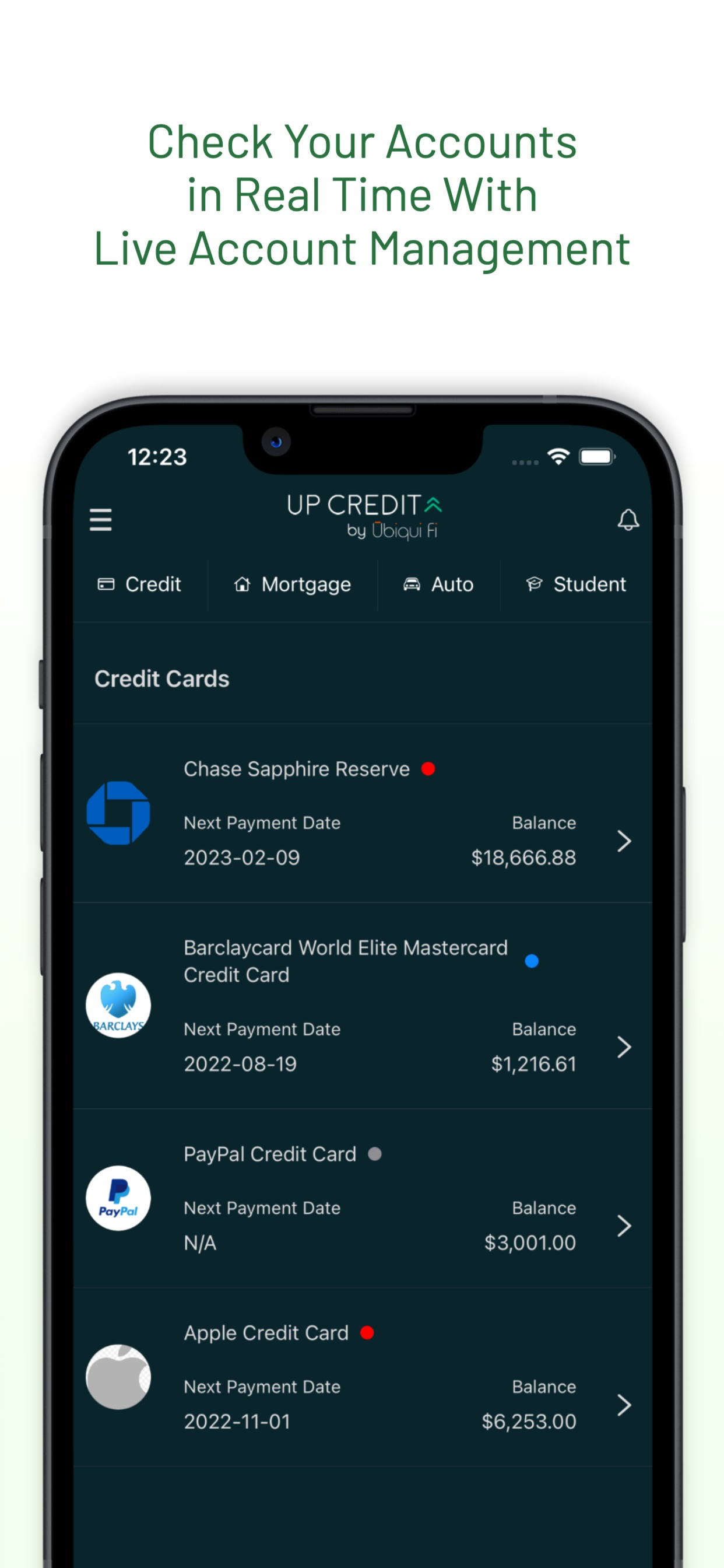

• Live Account Management* - Manage all of your accounts in near real time, so you will never miss an upcoming due date again.

• Custom Plans Tailored To You - Plan items that are tailored to your needs and help you gain a better perspective on what's going on with your credit all while guiding you along to a better credit score.

• Built For Fun - Have fun while building your credit by earning badges, scoring points, and leveling up! Who said finances had to be boring?

• Built For You - Skip the in-your-face ads. Advertisements are relevant, and are not intrusive, allowing you to have a seamless and focused experience in the app.

• Real Time Account Management - What other personal finance app gives you not only your credit score but ways to manage all of your credit accounts from a single app. (Automatic payments coming soon!)

FAQ:

Why Up Credit?

While there are many other personal finance apps out there that suit different needs, Up Credit is unique. Not only do we offer step by step solutions in order to help you pay off your debt, we also offer account management which gives you near real time insight into upcoming due dates, credit utilization and so much more.

Which credit bureau does my credit report come from?

There are 3 major reporting agencies, Equifax, Experian and TransUnion. We pull our basic user information from Equifax and premium users can upgrade to get information from Experian and Transunion, commonly called a 3 bureau credit report.

What score do we use?

Currently Up Credit pulls your score using the VantageScore 3.0 credit model. There are two types of scores, VantageScore and FICO.

Will checking my credit affect my score?

No. Up Credit performs what’s called a soft inquiry meaning that your credit score will never be affected when we check it.

What is a credit plan and how does it work?

Credit plans are unique to Up Credit. Our machine learning algorithm looks at your credit report and finds things that you can do to improve your credit.

What is a good credit score?

A good credit score ranges from 680 to 850. Most lenders look for you to be in this range in order to qualify for better rates.

How much is it to sign up?

Our plans start at just $0.99. For this you will receive a credit report and a credit score along with tips from our credit builder on how to improve your credit and so much more.

Why is a good credit score important?

In a nutshell, the better your credit score is the better rates you will get on loans and credit cards. On top of that, more doors will be open to you when applying for credit, giving you greater financial freedom and a lot less stress.

When should I check my credit score?

Remember, the more you check your credit score the better the chances that you will stay on top of your bills and all of the things that can hurt your credit.

* Live account management and 3B credit reports are offered in our top tiers only.

Hide

Show More...